Finance Marketing: 2024 Definitive Guide

Consumer finance is a competitive space. Banks, mortgage companies, credit cards, cryptocurrencies, and micro-investment apps crowd the scene, and every second, a new competitor emerges. And in the battle to one-up their rivals, there’s a slew of reward incentives in the shape of welcome APRs, flexible spending limits, and even outright cash offered for new customer sign-up bonuses.

Within finance marketing, there’s a broad range of proven promotional tactics you can pursue. But beyond promotions, successful fintech brands are using data-driven marketing tactics to humanize their brand, build one-on-one relationships, and offer custom-tailored incentives.

This article will discuss what exactly finance marketing is — who uses it and ways to use it effectively. We’ll highlight successful marketing campaigns, sharing examples across a mix of different channels. We’ll also address specific considerations for finance marketing given the crowded field of competitors and strict government regulation and provide specific examples of successful campaigns and winning tactics that your business can execute.

What is Financial Marketing?

Financial marketing is the marketing or promotion of apps, products, and services related to the financial services industry. Efforts typically relate to brand awareness, attracting new customers, or generating revenue. This may include performance marketing campaigns where the brand pays advertisers when their leads complete a specific action, such as installing an app or marking an opening deposit.

Here are some types of companies that use financial marketing.

- Commercial banks

- Credit unions

- Financial planning firms

- Wealth management firms

- Educational planning services

- Accounting firms

- Investment banks

- Micro-investment apps

- Insurance companies

- Brokerage firms

- Mutual funds institutions

These organizations may use financial services marketing to promote a variety of different products or services such as:

- Consumer or commercial banking

- Mortgages

- Car loans

- Credit cards

- Credit monitoring

- Wealth management

- Insurance

- Financial advice

- Stocks and investments

- Alternative investment products

- Accounting and bookkeeping

- College savings accounts

- Tax consulting

Financial services marketing is uniquely challenging from other types of marketing. Brands often have an uphill battle in building trust and credibility with a public skeptical of financial institutions. Additionally, there are strict guidelines that companies must adhere to when advertising a financial services business.

When promoting financial products and services, there are two primary methods that companies use:

- Digital marketing: Includes inbound and outbound channels like blogs, podcasts, SEM, SEO, social media, and pay-per-click (PPC)

- Traditional marketing: Includes print media and other forms of non-digital outreach like TV commercials, signage, billboards, benches, bus wraps, and event sponsorships

Many financial service providers use a mix of traditional and digital marketing strategies. Depending on the product type and customer demographics, some companies may rely more heavily on one form of marketing than the other.

Increasingly, digital marketing is proving the most effective marketing strategy for the financial sector. Most customers looking for financial services are doing so through digital channels like online search. Even if the next activity is a phone call to the business, customers largely begin their journey by finding companies through Google, Bing, and YouTube.

What Does Finance Marketing Do?

Successful finance marketing creates and grows long-term relationships between the financial brand and its customers. While some industries, like CPG or apparel, can be successful with only one-time customers, financial services companies must win the initial “sale,” and then retain and grow that relationship. Using all available marketing channels to reach members is critical; it’s all about customer loyalty.

Effective marketing strategies focus on the full sales funnel: Awareness, interest, consideration, intent, and evaluation. Full-funnel marketing can be challenging, but it allows you to begin your relationship with the customer well before they become a customer. When a consumer is ready to take action, like opening a new bank account, you want your brand top of mind for their consideration.

And beyond just opening a checking account, you need the customer to maintain the account, set up direct deposit and other fund deposits, and purchase other products or services like credit cards, CDs, or home mortgages. This means maintaining satisfaction and identifying the right opportunities to grow the relationship, blending in the right mix of bonuses, promotions, and new product offerings.

In the past, financial companies could be more sit-and-wait in their approach to customer acquisition and relationship-building. But to be competitive now, only a more hands-on approach will do.

Some of the reasons for this more aggressive stance in finance marketing include:

- Proliferation of fintech as a major disruptive force

- Increasing regulatory barriers that impact financial advertising

- Widespread public distrust in financial institutions

- Digital-first consumers

- Decline of traditional (non-digital) marketing

- Rise of social media

- Rise of influencers

- Amazon consumers who expect personalization and immediate gratification

Financial service marketing agencies are skilled at helping businesses navigate this landscape.

Are There Finance Marketing Agencies?

Yes, finance marketing agencies offer customized services for businesses in the financial services sector. Clients include banks, credit unions, insurance companies, investment firms, and mortgage brokers.

These specialized agencies are skilled at using a mix of marketing tactics, including memorable Super Bowl ads, finflueners on social media, and trending hashtags.

Beyond glossy ad campaigns, finance marketing agencies can assist with understanding your audience and identifying new audience segments, managing affiliate partnerships, market research, competitive intelligence, brand-building, and content creation. They are skilled at using a range of omnichannel marketing tactics to engage consumers.

Traditional and Digital Marketing Campaigns

Most finance marketing companies will use a blend of traditional and digital or internet-based marketing. While many think of print media as old-school and dated, financial service providers will likely always use some form of it in their efforts.

Print advertisements in newspapers, as one example, have a powerful legacy prevalence. Although Generation Z prefers to get its news online, 29% of Zoomers — nearly 1 in 3 — read print newspapers at least once a month and 17% of Zoomers read print newspapers at least weekly.

Bus wrap campaigns, targeting younger digital native consumers, can be especially effective for their in-your-face disruptive appeal — especially when elevated with beautiful design.

Even more traditional finance businesses that rely on inbound phone calls, digital marketing is critical. A 2016 study found that digital channels, like Google Search, drive 92% of calls to a business.

Let’s take a look at some successful examples of finance marketing across a range of mediums.

Finance Industry Billboard Ads

First Ontario Credit Union ran a successful billboard campaign advertising their mortgage products.

Financial Influencer Marketing

On TikTok many popular #Fintok influencers, called finfluencers, give advice on financial products and services like life insurance, day trading, cryptocurrency, and credit card debt.

Instagram has many popular financial influencers as well, like @humbledtrader who promotes the mobile trading app TradeZero in this video post.

YouTuber Brennan Valeski does a review of Credit Karma and includes an affiliate link. He also promotes Webull in a text link on the same page.

FinanceBuzz, a large news outlet and affiliate publisher, uses Facebook among many other channels for customer outreach.

Email Marketing

This email from Baxter Credit Union offers auto financing. Based on customer data, the credit union targets existing customers who meet certain borrower criteria.

TV Commercials

This television ad for Peachtree Financial Solutions is an example of more traditional advertising. It offers a toll-free number for customers to call and also displays the company’s website.

Investment management service, Wealthsimple, ran a memorable Super Bowl ad telling viewers that they make a complicated process, investing, simple.

Affiliate Marketing

Affiliate marketing offers a strategic way to reach your target audience. Affiliate partners — publishers — will share your company with their own readers or customers and encourage them to complete a targeted action, like signing up for a newsletter or installing a free app.

The affiliate publisher is compensated for promoting your company, and your company receives high-quality leads – consumers who may have more trust in your brand as a company than typical website visitors as they already have a warm introduction from a trusted “friend.”

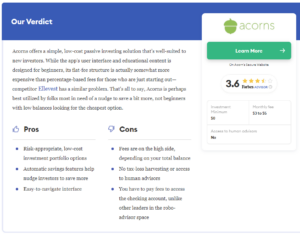

Financial news giant, Forbes, engages heavily in affiliate marketing. It will rate, review, or recommend many different financial products and services. When one of their readers signs up from an affiliate link, Forbes receives a commission.

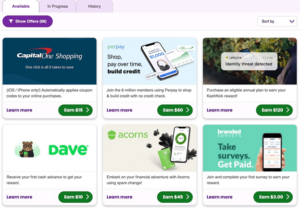

Kashkick is a rewards site with a diverse user base looking to earn extra money, gift cards, and cash-back rewards. Users are also motivated to save money and make financially savvy decisions, such as choosing the best banking service or credit card. Many financial companies leverage these types of sites for brand exposure and to entice these bargain-motivated consumers to try their own offerings.

Thinking Omnichannel

With such a diverse range of ways to reach new and existing customers, an omnichannel approach is critical. Omnichannel marketing is an all-fronts approach.

It means that your company provides customer outreach and consistent messaging across a wide range of touchpoints, covering all the places where they prefer to experience your brand. Consumers can engage with your company on their terms — through website, email, chat, app, social, television, print media, phone, or even in-person if you have physical locations.

This all-fronts approach provides more personalized and cohesive service to customers and enhances customer satisfaction and loyalty.

251% More Engagement

A 2019 study by Omnisend found that omnichannel marketing campaigns had an 18.96% rate of engagement versus 5.4% for single-channel outreach. In other words, using an omnichannel approach drives a 251% higher rate of conversion. Additionally, businesses that use multichannel marketing have a 90% customer retention rate.

Adopting Omnichannel

Adopting an omnichannel strategy is a must for financial organizations who want to build life-long (or acquisition-long) relationships. It relies on wooing the consumer at every phase of the customer life cycle and making it easy for customers to re-engage with the company on their terms.

Some real-life examples of omnichannel marketing include:

- Buying online but returning in-store.

- Checking into a physical store with the store’s app to earn loyalty rewards later redeemable online.

- Sharing promo codes on social media for future promotions

- Emailing customers to sign up for an offline event

For a financial services firm, this could be a QRC advertisement on a billboard or bus wrap. Or sending a card in the mail and asking and asking the customer to go online to activate the card.

Can I Use a Regular Marketing Firm for My Finance Marketing?

You could but agencies with experience working with financial services companies can deliver strong results and are better positioned to navigate a complex, regulatory environment.

As a recent example of marketing strategies gone awry, the Federal Trade Commission (FTC) fined Financial Education Services $213 million for making exaggerated claims and in September 2023, the U.S. Securities and Exchange Commission (SEC) fined nine investment advisory firms for not implementing new policies related to advertising hypothetical performances.

And beyond regulatory compliance, experienced finance marketing companies bring another level of expertise. For consumers, money is personal. It’s often a source of stress or shame. Everyone’s reliant on it. And money is very emotionally charged, as it ties to the ability to create a home, care for family, and access healthcare.

Regardless of the type of agency you work for, hiring one for your finance marketing is probably a smart idea.

- Business flexibility. Working with an agency means you don’t need to hire additional employees in-house. You can easily scale up or down marketing resources.

- Complementary expertise. You don’t need to outsource everything. You can have an agency partner handle certain aspects where you lack expertise, such as SEO marketing, writing whitepapers, affiliate networks, or social media management.

- Finance space know-how. Partnering with an agency adds industry experience for marketing effectiveness and compliance.

How Do I Find a Finance Marketing Agency for My Business?

When looking for a finance agency, consider your goals and budget, then research different financial marketing agencies. It’s also a good idea to ask for recommendations from industry connections. Talk to multiple agencies. Evaluate their portfolio and ask questions about their working style. Be specific about your needs.

It’s not unreasonable, or uncommon, to work with more than one agency. A finance company might work with one firm for social media marketing, another for content marketing, and a third one yet for branding or television campaigns.

Vibrant Performance, for example, is skilled in helping clients with affiliate program management, content strategy, targeted partnerships, and influencer marketing across popular social media platforms.

Bottom Line

Finance marketing in 2024 requires a balanced mix of innovative digital strategies and traditional methods. Success relies upon personalization, data, and a deep understanding of a shifting and complex regulatory landscape.

Banks, firms, and fintechs should focus on building long-term customer relationships that use evolving technologies to keep connected on the internet and metaverse, and also offline through print media and other non-digital forms of communication.

Increasingly, financial companies are partnering with multiple, specialized agencies to provide valuable expertise while also managing many marketing aspects in-house.